A data universal numbering system (Duns) number is a unique identifier for businesses registered with Dun & Bradstreet. The number is used to track a company’s business credit file and score. It is also used by financial institutions as a vetting process to determine a company’s creditworthiness.

Having a duns number is important because it is one of the ways that creditors can determine a company’s creditworthiness. It is also a fantastic way for small businesses to build business credit.

Who is Dun & Bradstreet?

Dun & Bradstreet is one of America’s oldest companies. The company was founded in 1841 by Lewis Tappan. He started it so merchants could make informed decisions by identifying businesses and checking the creditworthiness of potential customers.

Dun & Bradstreet (D&B) is a company that collects data from millions global businesses from all over the world. They have information on over 265 million businesses, and over 100 million of those businesses have been given a DUNS number. In 1994, the federal government agencies began using the unique nine digit identifier DUNS number as its main business profile identification system.

The DUNS number was incorporated in 1998 as the federal government’s contractor identification code. This means that companies without a DUNS number cannot do business with federal government agencies. A DUNS number is very important for many small businesses because government contracts are often a stable and lucrative source of income.

What is a Duns number and why is it important?

A DUNS number is a Dun & Bradstreet-generated unique identifier for companies. It’s used to assess a company’s creditworthiness and a business credit report score. It’s also employed by lenders to evaluate a business financial soundness.

Just as your social security number can reveal a lot about your personal credit, your DUNS number reveals similar information about your business credit. This number is used to track businesses and can be used to assess credit risk, among other things.

DUNS numbers are also leveraged by many large corporations as part of their vendor registration process. A DUNS number is often required in order to do business with these entities.

If you’re thinking of starting or expanding your business, it’s a good idea to obtain a DUNS number as soon as possible.

How to get a Duns number

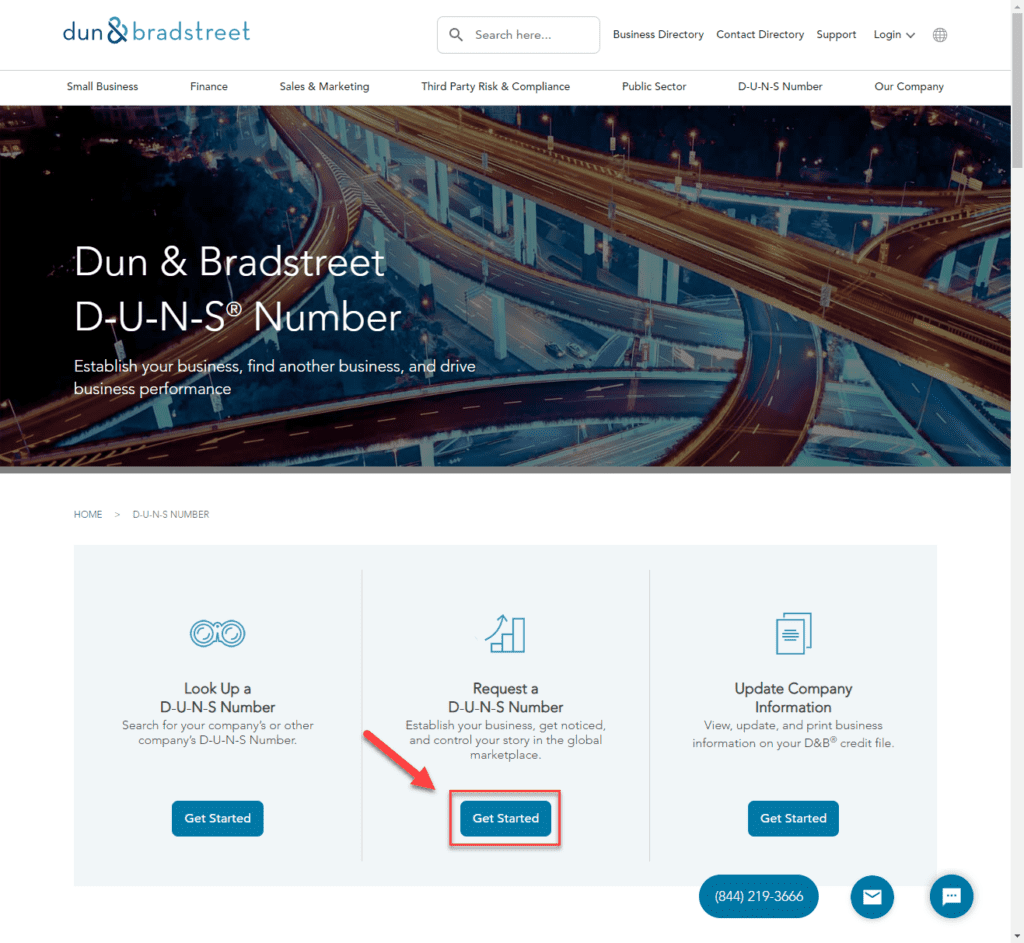

You may apply for a DUNS number online directly through Dun & Bradstreet’s website if you want one for your business. Visit the D&B DUNS Number request page to get started.

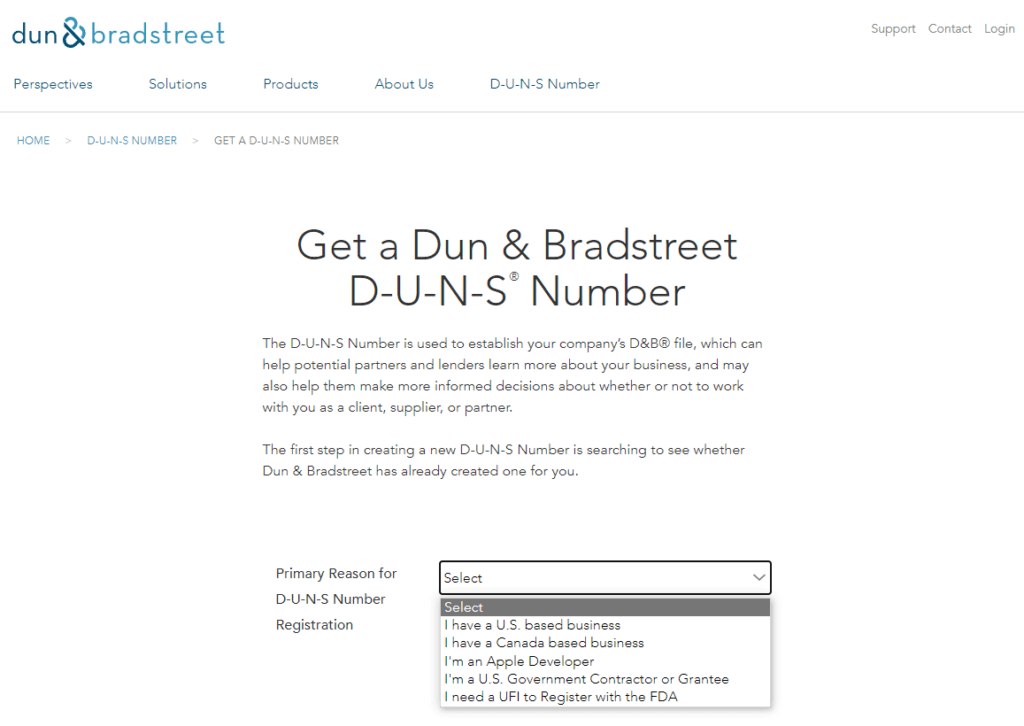

D&B will ask you for the main reason you want a number. If you are based in the United States and aren’t doing business with the federal government, select “I have a U.S. based business.” If you’re a contractor for the US government, you can visit the D&B Federal government request site and request your DUNS Number there.

After you’ve completed the application, D&B might contact you to walk you through the process and give you your DUNS number within 30 days, however, if the information can be confirmed with D&B’s data sources, you may get your number immediately.

The more you learn about business financing, including the importance of business credit cards and business tradelines, and how reporting to the business credit bureaus is a key factor to the growth of your company, the more your DUNS number will work in your favor.

What information is required to get a Duns number

To get a duns number, you need to establish your business as a legal entity with your state first. This means that you need to create an LLC, C-Corp, S-Corp, or some other legal business entity. As a side note, while you are getting your company registered, get your employer identification number while you’re at it.

When applying for your DUNS Number, you will first be asked to search for your business name to see if they can locate it in their database.

You’ll need to provide basic information like your legal name, the name of your business, physical address, and your business number, whether you’re a home-based business, and the number of workers at your physical location when inside the app.

How to use a Duns number to improve your business credit profile

Once you have set up your business by applying for an EIN from the IRS, getting a D-U-N-S number from Dun & Bradstreet, and opening a bank account for your business, you may want to apply for a credit or trade account.

Since a new small business may not have any financial health indicators like a previous bank loan to refer to when applying for credit, paying your bills on time can show that you are a good risk. Having a good financial record can help you when you are trying to sell your home.

Tips for improving your business credit report

If you’re looking to improve your business credit rating, there are a few things you can do:

– Make sure you pay your bills on time, every time. This is the most important thing you can do to improve your business credit score.

– Keep a close eye on your spending and make sure you’re not overspending.

Want to learn more?

Read Learn how to build business credit fast next.

In Summary

A DUNS number is a unique identifier for businesses registered with Dun & Bradstreet. The number is used to track a company’s business credit report and score. Dun & Bradstreet. The number is used to track company information, sales, services, number of employees, number of partners, and different financial health indicators including payment history. It is also used by lenders to determine an organization’s creditworthiness.

So, it’s best to get a DUNS number early in the business startup process to help establish your credit history and improve your chances of getting approved for a loan or line of credit down the road.